2025 Board of Review Highlights

Be sure to review the 2025 Board of Review Rules and Procedures prior to filing a 2025 Complaint Form Packet. Significant changes to the Rules and Procedures are highlighted in yellow. Some of these changes include:

- Copy of current license will be required of all professionals testifying at a hearing. (Pg. 5)

- Complainant Additional Evidence Deadlines:

- Complaints requesting an EAV reduction of less than 100,000 must file all additional evidence no later than 15 calendar days following the final date for filing complaints, except that when the time period expires on a Saturday, Sunday or a County Observed Holiday, the time period shall be extended to include the next following business day.* (Pg. 10)

- Complaints requesting an EAV reduction of 100,000 or greater must file all additional evidence no later than 30 calendar days following the final date for filing complaints, except that when the time period expires on a Saturday, Sunday or a County Observed Holiday, the time period shall be extended to include the next following business day.* (Pg. 10)

- All complaint filings must include the original and one copy of the complaint form and the original and one copy of all written evidence. (Pg. 11)

- The Board of Review requires the appraiser who prepared the appraisal report on the subject property attend the hearing in order to answer any questions or to provide additional clarification. (Pg. 16)

Hearing & Deliberation Location

County Administration Building

404 Elm St, Room 301 or 303 (& Virtual)

Rockford, IL 61101

If you would like to attend a meeting virtually, contact our office at

Hearing Schedules

11/19/2025 - Revised (11/17/2025)

12/08/2025 - Revised (11/17/2025)

01/06/2026 - Revised (01/05/2026)

01/13/2026 - Revised (01/06/2026)

01/20/2026 - Revised (01/07/2026)

01/21/2026 - Revised (01/21/2026)

01/26/2026 - Revised (01/20/2026)

01/27/2026 - Revised (01/16/2026)

01/29/2026 - Revised (01/20/2026)

02/04/2026 - Revised (01-30-2026)

02/05/2026 - Revised (01-28-2026)

02/09/2026 - Revised (01-26-2026)

02/10/2026 - Revised (02/10/2026)

02/11/2026 - Revised (01-28-2026)

02/12/2026 - Revised (02/11/2026)

02/23/2026 - Revised (02/20/2026)

Deliberation Schedule

12/11/2025 at 1:00 PM

01/23/2026 at 9:00 AM

02/06/2026 at 9:00 AM

02/13/2026 at 9:00 AM

02/23/2026 at 10:30 AM

Public Notices

Approved Minutes

Information & Forms

The system for appealing property assessments in Illinois is a multi-level system that affords several opportunities for taxpayers to have incorrect or inaccurate assessments corrected. Those levels include the Township Assessor level, the County Board of Review level, the Illinois Property Tax Appeal Board level, and if the owners are still not satisfied after exhausting these administrative remedies, they can take their appeal to court.

Informal appeal

If a property owner thinks their assessment is incorrect, the township assessor should be the first person contacted. An assessor who still has the assessment books for a given year can correct any assessment. Calling an erroneous assessment to the assessor's attention early in the year may result in a correction without using the formal appeal process. Property owners should contact their township assessor for information.

Formal appeal

If the property owner still thinks their assessment is incorrect, they are entitled to proceed with a formal appeal to the county Board of Review, if the deadline for filing a complaint has not passed.

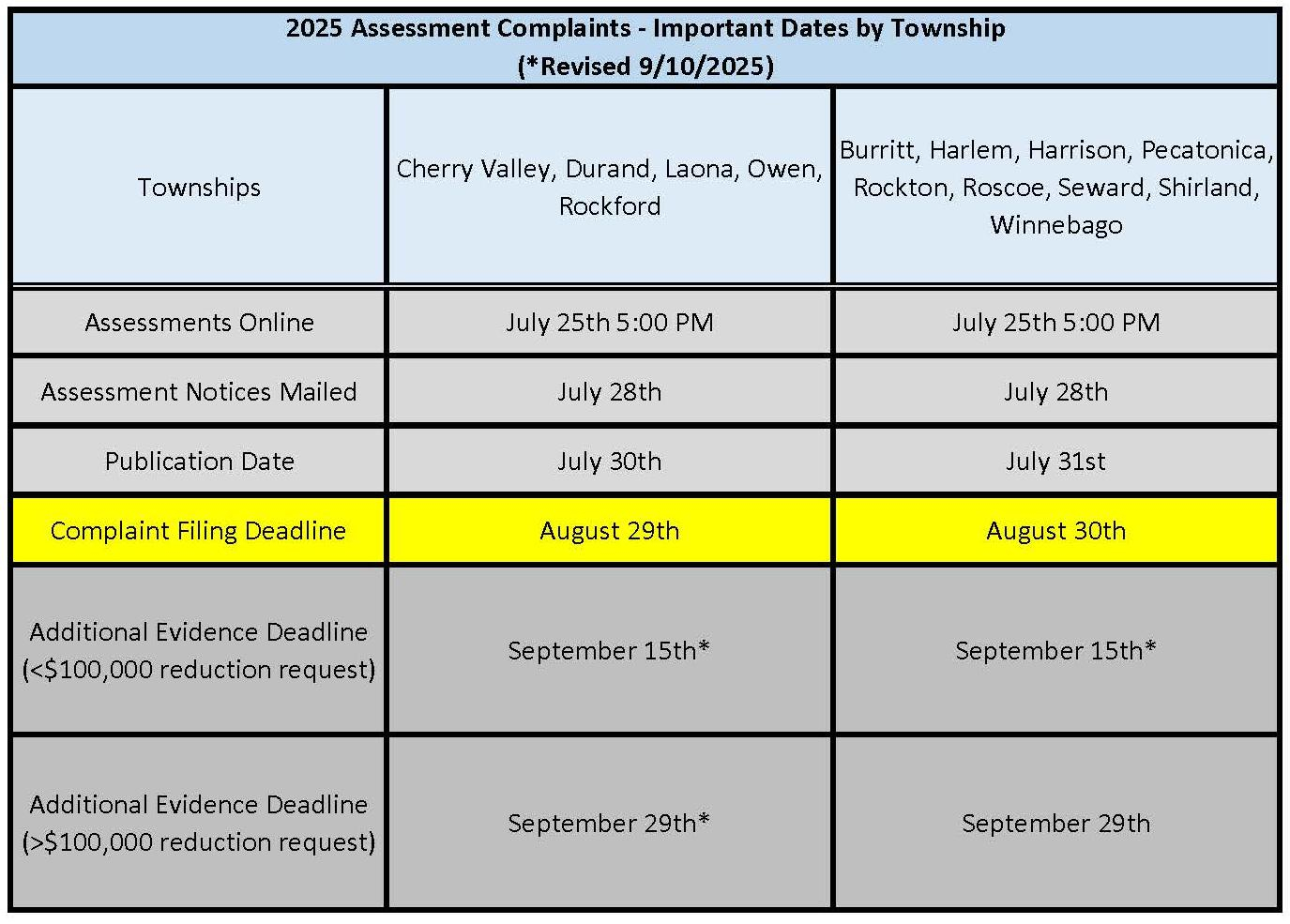

The following Important Dates & Deadlines are set in compliance with Illinois Statute (35 ILCS 200) and the 2025 Board of Review Rules and Procedures. Our office is not open Saturdays and Sundays, along with County Holidays; Therefore, if unable to come into our office during normal business hours prior to the applicable deadline, then the complaint(s) and/or evidence must be postmarked by the applicable deadline.

2025 Board of Review Rules and Procedures - Revised 9/10/2025*

Comparable-Property Grid Sheet (Residential)

Comparable-Property Grid Sheet (Commercial/Industrial)

Timing of appeals

The statutory time for filing appeals (complaints) with the county Board of Review is 30 calendar days after the assessments are published.

Appeals to the Illinois Property Tax Appeal Board

If the property owner is dissatisfied with the Board of Review's decision, the owner can appeal the assessment to the State Property Tax Appeal Board (PTAB). Forms for filing that appeal are available in the Supervisor of Assessments and Board of Review Offices. Appeals to the PTAB must be postmarked within 30 days of the date of Board of Review's decision. PTAB hearings are generally held in Springfield, Illinois.